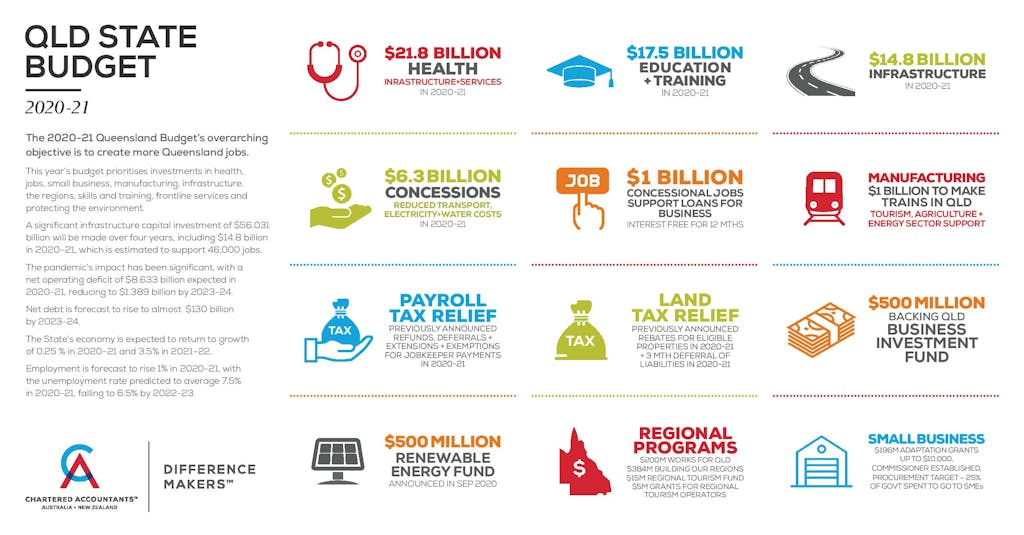

The Queensland Government has released its budget for 2020-21. The budget boasted the following highlights:

- Safeguarding our health – funding for health services with a focus on ensuring the State is ready for any future COVID-19 outbreaks

- Investing in frontline services – investment in more nurses, doctors, other health professionals, teachers, community service staff, firefighters, paramedics, and police personnel

- Backing small business – continued support for small businesses in the state

- Investing in skills – investing in teachers, students, and future skilling programs

- Building Queensland – infrastructure investment to support Queensland’s economic recovery, growth of the state’s regions and a focus on business-led growth

- Growing our regions – delivering necessary support to enable regions to grow and economically prosper

- Making it for Queensland – encouraging growth in the manufacturing sector

- Supporting Queenslanders – continued support in response to COVID-19 for businesses, industry sectors, workers, homeowners, renters, and individuals

Whilst backing small business is a focus, the budget heavily relies on previously announced support for its small business measures. The list of ongoing, immediate support initiatives was a lot shorter than expected. There are still some notable relief measures to be across.

what you should know

Payroll tax relief

The government previously issued refunds and rebates for payroll tax. These are no longer available but there are still relief measures available for those employers still finding their feet.

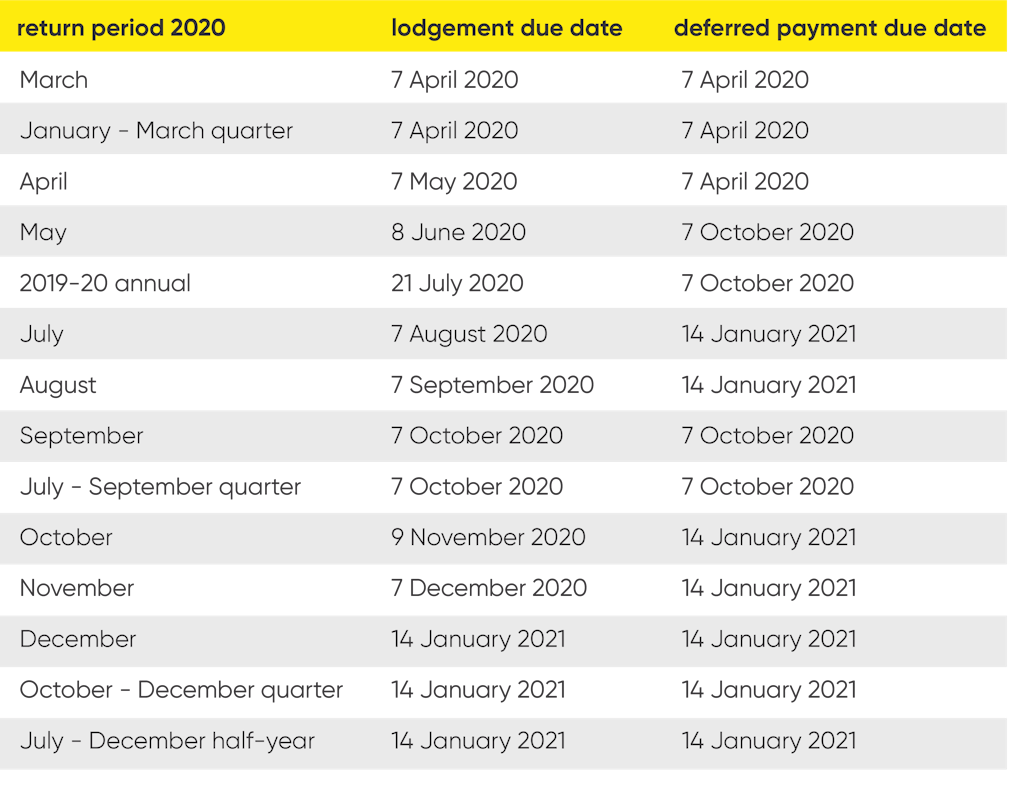

Deferrals for payroll tax payments

- 12-month deferrals for Payroll Tax payments from lodgement due dates

- Timely lodgement of Payroll Tax Returns is still required

- No interest will apply if those payments are made by the deferred due dates

- Applications for deferral are due by 31 December 2020 [apply for deferral via business.qld.gov.au]

JobKeeper wage subsidy exemption

- JobKeeper payments are not included in calculating your threshold amount and payroll tax rate

- If you pay an employee more than the JobKeeper amount, the extra amount is liable for payroll tax

- When you lodge your returns:

- include any extra amounts in the ‘Taxable wages’ section,

- include JobKeeper amounts in the annual return at the ‘Other non-taxable wages’ section, and

- the superannuation you pay in addition to the JobKeeper payment is taxable and should be included in your returns.

Summary of current deferral dates

Backing Queensland Business Investment Fund [BQBIF]

The Business Investment Fund, managed by QIC, will primarily consider co-investment opportunities in small to medium-sized businesses. QIC’s current key investment criteria requires businesses to:

- have significant growth potential [i.e. growing operations in Queensland, expanding in Queensland, or relocating to Queensland] and demonstrate continued economic growth in Queensland

- utilise the funds to create significant Queensland-based jobs

- have a proven product and defined market opportunity but require significant capital to build scale or grow market share

- be relatively mature, well beyond proof of concept and generally profitable or approaching profitability

- be seeking capital to expand or restructure operations, enter new markets or finance significant acquisitions

- not be an investment fund

- not be conducting any of the following as their primary business activities:

- finance [other than finance technologies],

- insurance [other than insurance technologies], or

- property development, land ownership, or construction [other than construction technologies].

The framework and process around this is yet to be confirmed by the QIC so it is not yet clear how the eligibility criteria and application process will work. Registrations of interest are available via email: bqbif@qic.com.

Small business adaptation grants

These grants are up to $10,000 per eligible business. Whilst they are no longer available for businesses in South East Queensland, they are still available for some limited regional small businesses that meet the following eligibility requirements:

- have been subject to closure or otherwise highly impacted by current shutdown restrictions announced by Queensland’s Chief Health Officer on 23 March 2020

- have experienced a minimum 30% decline since 23 March 2020, over a minimum 1-month period due to the onset and management of COVID-19

- employ staff and have fewer than 20 employees at the time of applying for the grant [employees must be on your payroll and does not include the business owner/s]

- have a valid Australian Business Number [ABN] active as at 23 March 2020

- be registered for GST

- have a Queensland headquarters

- have an annual turnover over $75,000 for the 2018–19 or 2019–20 financial year, or you can provide financial records that show this will be met for recently started small businesses

- have a payroll of less than $1.3 million

- not be insolvent or have owners or directors that are an undischarged bankrupt

Applications for this grant are available via business.qld.gov.au.

Other commitments to queensland businesses

- Funding to support the transport industry and the North Queensland ports and related businesses

- Funding to reduce irrigation water charges for farmers and fruit and vegetable growing businesses

- Deferral of the gaming machine tax and the health services levy until June 2021

- Newly established office of the Small Business Commissioner in charge of information and advocacy of the state’s small business operators

- Procurement target of 25% of all government spending to go to small and medium businesses

- On-time Payments Program to improve payment practices and timeframes

- Embedding a ‘Buy Queensland’ approach, increasing opportunities for local suppliers, growing regional economies, and embedding non-price considerations [e.g social procurement and local benefits] into government procurement processes

Chartered Accountants of Australia and New Zealand have prepared a handy summary of the Qld Budget announcements:

After what has been a huge year, the last thing anyone needs is more detail. If you would like to find out what the budget really means for you and your business, give us a call on 1300BDEPOT or email us at oneplace@businessdepot.com.au to speak to a business financial advsor.