The ATO has come out swinging in 2024 with a significant spike in not only the amount of activity pursuing debts but also an increase in the willingness to go harder faster.

Director Penalty Notices

As quoted in an Accountants Daily article recently, the Tax Office has issued 18,343 director penalty notices [DPNs] to directors since 1 July 2023 relating to more than $2.5 billion of company tax liabilities. And, apparently, “around a quarter or 4,695 were issued in just the first 2 months of the year”.

Company directors can be personally liable for unpaid PAYGW [pay as you go withholding], SGC [super guarantee charges] and GST [goods and services tax] of a company they’re a director of.

Once a director is issued with a director penalty notice [DPN], the ATO can recover the above mentioned taxes from the personal assets of the director. Yes, this is pretty much as bad is it can get for a director.

The DPN will set out the unpaid tax amounts and what remission options are available for the director. Depending on how long it has been since the ATO debt was reporting, remission options include:

- paying the debt in full

- voluntarily appointing an administrator to the company

- appointing a small business restructuring practitioner under the Corporations Act, or

- start winding up the company

Once issued, the ATO can recover from the director by:

- issuing garnishee notices

- offsetting any of your personal tax credits against the company’s debts

- initiate legal recovery proceedings

The long and the short of it is, if you get a DPN, you need to take it very seriously and you definitely need to do SOMETHING!

Court Actions

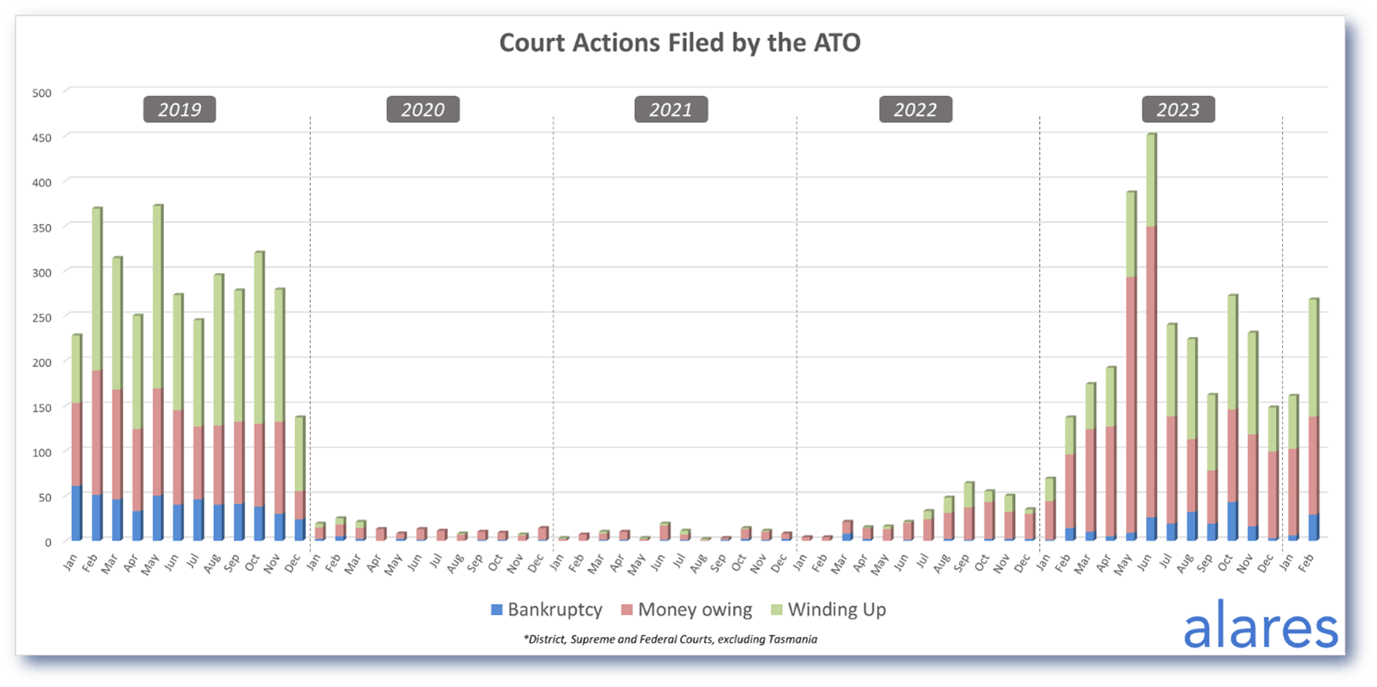

In March 2024 Alares Insights Report shows court actions filed by the ATO have jumped again in February 2024 and are back around pre-Covid levels.

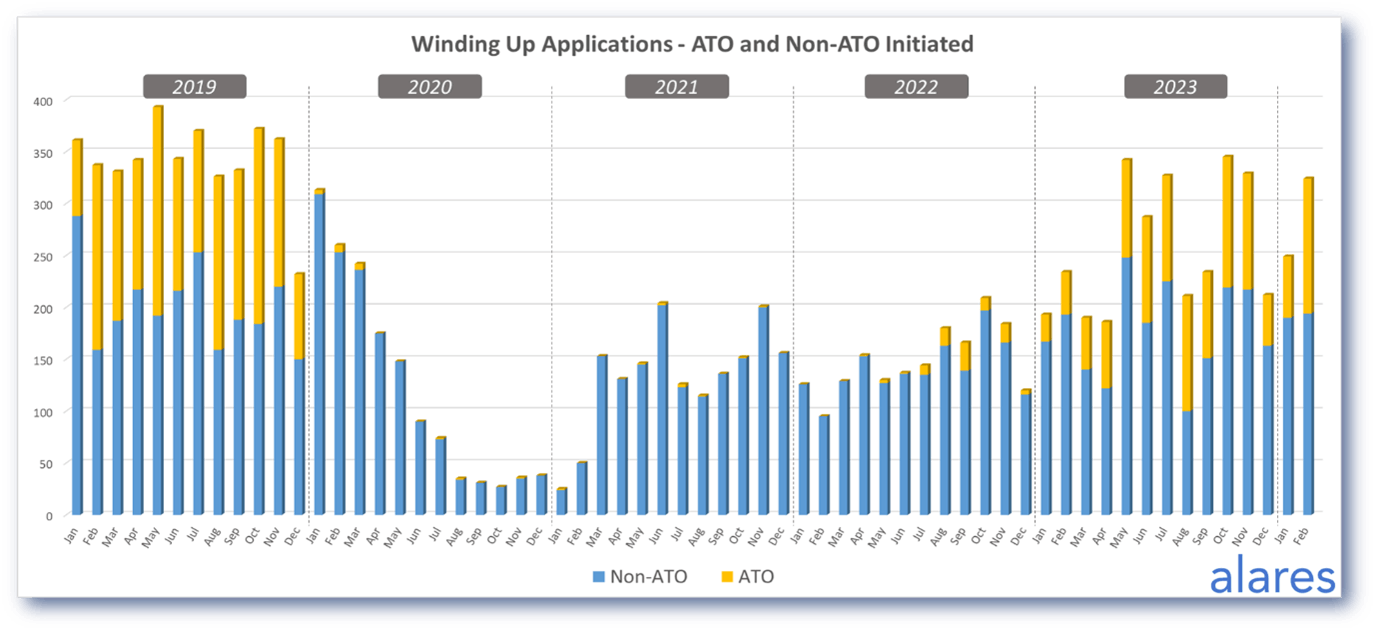

724 wind-up applications have been filed since 1 July 2023 and 130 entities actually wound up. The ATO generally are representing a much greater share of all windup actions too!

Source: Alares Insights March 24

ATO activity + insolvencies

Lee Crosthwaite of Worrells, Insolvency + turnaround practitioners, says they are fielding a noticeable increase in enquiries as a result of increased activity from the ATO.

He states “I’m observing a fairly common play by the ATO at the moment when chasing company debt [particularly where there is SGC owing]:

- Sending all the warning letters

- Attempt phone calls to directors and accountants [if one answers, ATO will usually give 2 months for action]

- Do the credit reporting for those debts over $100k

- Issue DPN on directors, and often also a Statutory Demand on the company at the same time.”

In my experience, the important thing to note with this process is that the ATO is not mucking around as much as they have in the past and they are pursuing debts, using all the artillery in their possession to go harder, faster.

Jarvis Archer of Revive Financial says, ‘We’re in a perfect storm for higher levels of insolvency over the coming year. Insolvencies have tracked 40% more than pre-pandemic levels for the 6 months from October to March and they just seem to keep going up.

When I quizzed Jarvis on why insolvencies are trending up, Jarvis said, “In 2020, small business owed the ATO about $12 billion. That number has nearly tripled to $34.1 billion. So this trend is an effort to get the debt down.”

“The ATO are throwing everything at it, including the recent rollout of garnishee notices which I haven’t seen since 2018” says Jarvis.

This is in line with what we are seeing too with business owners now having depleted their pandemic savings and using the ATO as a bank again.

We are also seeing increased audit activity include the Next 5000 tax performance program which is funded by the Tax Avoidance Taskforce to ensure Australia’s largest privately owned groups are paying the right amount of tax.

The moral of the story

Take the ATO seriously! They are not willing to be a second-tier funder to you anymore and are pursuing outstanding liabilities with vigour. If you’re a director, you can be made personally liable for some of the ATO debts of your company. If you do get issued with a DPN, you need to contact your advisor as a matter of urgency.

In the meantime, if you have outstanding debts with the ATO, be proactive and get payment arrangements in place, and stick to them while also staying up to date with all upcoming obligations.

we’re here to help!

If you have any questions or would like to know more about your obligations as a director, reach out to your advisor at businessDEPOT or call 1300BDEPOT.