Even though JobKeeper 2.0 was announced back in July, the information necessary to make a final assessment of eligibility has only recently been released.

Once you have reconciled your September accounts, you should now have everything needed to help determine if you are eligible for the extension of JobKeeper past 28 September 2020 through to 28 March 2021.

What has changed?

Let’s start with a summary of the key changes from the original JobKeeper and what you need to know to review your eligibility for JobKeeper 2.0.

- Now based on actual GST turnover [projections no longer sufficient and eligibility will need to be assessed based on actuals and maybe before you have even finalised your September BAS]

- Basic test requires you to be down 30% for the quarter [one month no longer sufficient]

- Must assess actual GST turnover on the same basis [i.e. cash or accruals] as you lodge your BAS [no longer can you choose between cash and accruals unless you are not registered for GST]

- To remain eligible from 4 January 2021 onwards you need to reapply the tests for the December quarter

- JobKeeper payment rates have reduced and split into 2 tiers to allow a lower amount for part-timers and casuals [see below for detail]

- Have until 31 October to meet the wage minimum payment conditions for all employees however, going forward this concession will be removed again [necessary given some businesses will not know if eligible until they lodge their BAS]

- Some changes in the time periods relevant for alternative tests – generally allowing testing against period preceding the test period or period preceding 1 March 2020

- Long term casual employees only eligible for the full rate if worked 80 hours or more in the 28 days finishing on the last pay period that ended before either 1 March 2020 or 1 July 2020 [hours include annual, long service, sick, carers leave and public holidays]

- Business participants need to have worked 80 hours or more in the 29 day period in February 2020 to be eligible for the full rate [and provide a declaration to the business entity confirming their hours worked over the reference period]

- Capital asset sales will be included in actual GST turnover given the definition of GST Turnover

- Choose tiers for each eligible employee and notify ATO through Single Touch Payroll [STP]

- Monthly declarations to include tiers relevant for employers

What has not changed?

We summarise the key components of JobKeeper that have not changed as follows.

- Employee eligibility criteria for JobKeeper 2.0 remains the same – employees are eligible if they were employed as at 1 July 2020 [updated from the original date of 1 March 2020]

- Employers still need to have been carrying on business as at 1 March 2020

- 30% decline in turnover required for businesses with less than $1billion in turnover

- 15% decline in turnover required for ACNC registered charities

- Business participants may still be eligible

- GST turnover includes taxable and GST-free supplies [but excludes input taxed supplies like residential rental income and financial supplies]

- Jobkeeper and Cash Flow Boost Payments should all be excluded from turnover calculations

- Alternative tests are still available [although with some amendments to the comparison periods]

- If your business is part of a group, each entity and its employees need to meet the eligibility tests in their own right, unless the service entity ‘look through’ rules apply for the group

- Eligible employees must be paid a minimum JobKeeper payment

- Casual employees still need to have been employed on a regular and systematic basis for the 12–month period before either 1 March 2020 or 1 July 2020

- Nomination forms are still required although no need to do new nomination forms if already previously provided one and they remain eligible

- The ‘one-in, all-in’ rule requiring you to provide JobKeeper Payments to all eligible employees

- Monthly declarations still required every month

- Business participants are only eligible if actively engaged in the business as at 1 March and in the relevant JobKeeper fortnight.

JobKeeper Payments and Minimum Wage Conditions

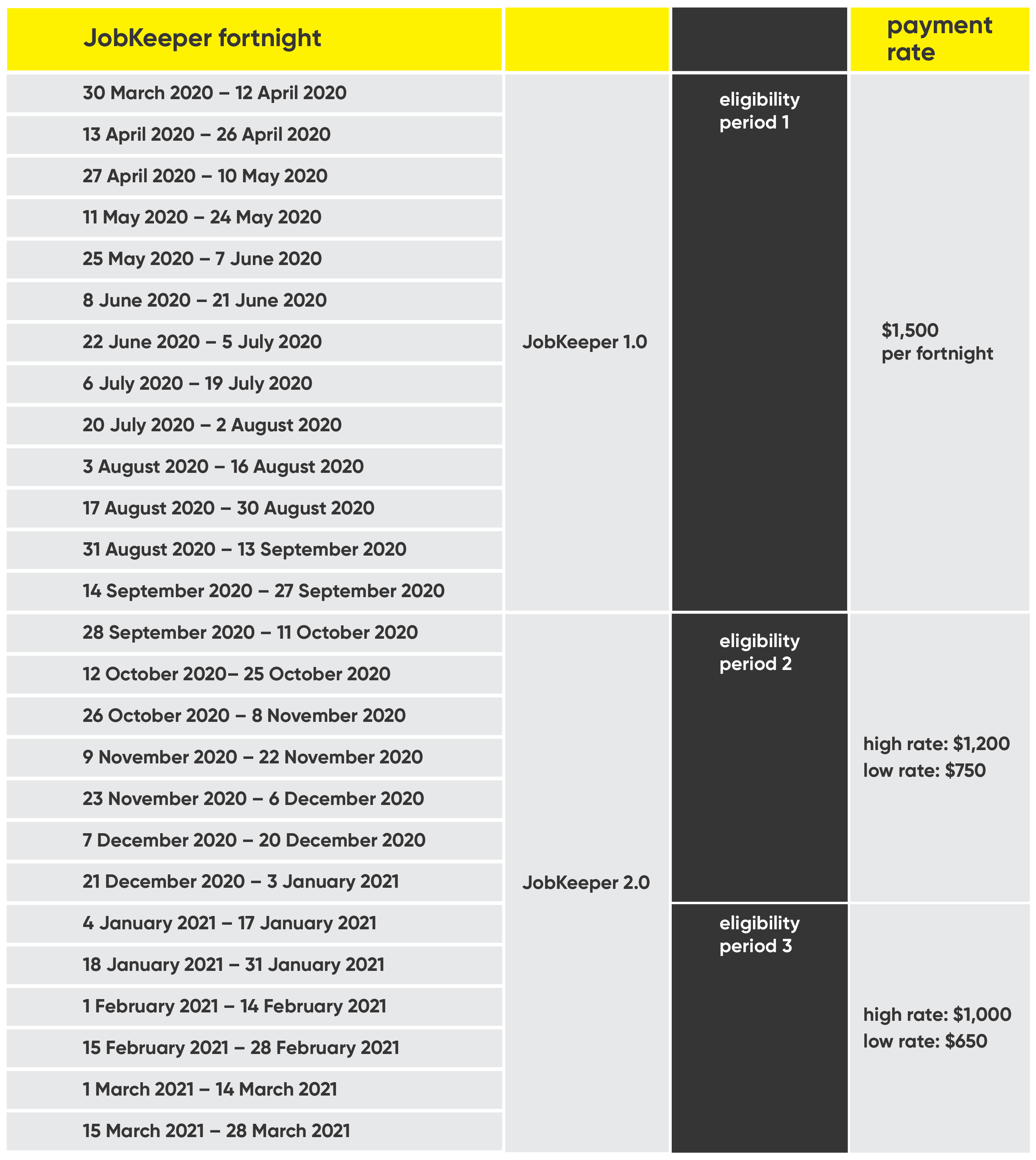

The payments that will be made and the minimum amounts to be paid are as follows:

From 28 September 2020 to 3 January 2021 payments will be:

- $1,200 per fortnight for eligible employees working more than 20 hours per week, and

- $750 per fortnight for other eligible employees and business participants.

From 4 January 2021 to 28 March 2021 payments will be:

- $1,000 per fortnight for eligible employees working more than 20 hours per week, and

- $650 per fortnight for other eligible employees and business participants.

Commonly Applied Alternative Tests

The alternative tests are still available to assess eligibility however there are some important changes to the alternatives tests which could help you meet the eligibility requirements.

Irregular Turnover [eg building and construction industry]

- Look at previous 12 months before test period or 12 months before 1 March 2020

- Divide into 3–month periods

- Lowest GST turnover for any of these periods needs to be 50% or less of the highest month period to be eligible to apply this test

- Important that entity turnover cannot be cyclical

New business starting before 1 March 2020

- Compare actual GST turnover for the test period [September quarter] with the average turnover since the entity commenced [using whole months]; or

- Compare actual GST turnover for the test period with the turnover of the 3 months immediately before 1 March 2020.

Disposals, acquisitions and restructures

- Compare the actual GST turnover for the test period with the actual GST turnover for the relevant month immediately after the disposal, acquisition or restructure, multiplied by 3.

- If there is no whole month after the last disposal, acquisition or restructure and before the turnover test period, then the month immediately before the turnover test period is used.

- If there have been multiple disposals, acquisitions or restructures, you can use the whole month immediately after any of the disposals, acquisitions or restructures, multiplied by 3.

Substantial increase in turnover

- The test can be applied if turnover increased:

- by 50% or more in the 12 months before the turnover test period or before 1 March 2020, or

- by 25% or more in the 6 months before the turnover test period or before 1 March 2020, or

- by 12.5% or more in the 3 months before the turnover test period or before 1 March 2020.

- If eligible to apply, comparison to determine decline in turnover can be made to the 3 months of turnover immediately preceding the test period or period before 1 March 2020.

The other alternative tests still also apply for those who have no comparable turnover due to either droughts and natural disasters, or the sickness, injury and leave of a sole trader or partner in a small partnership.

Business temporarily ceased trading during the relevant comparison period

This test can be applied if a business temporarily stopped trading due to a circumstance outside of the ordinary course of business during the relevant comparison period.

Trading needs to have ceased for a week or more and have resumed before 28/9/20.

There are two options for this alternative test:

- Use the turnover for the same period in the year before the business ceased training. For example, if the business was closed during the September quarter in 2019, use the turnover for the September 2018 quarter.

- Use the turnover in the 3 months immediately before the month in which the business temporarily ceased trading as the comparison period. For example, if a business ceased trading at 15th September 2019, you would use turnover for the quarter from 1/6/19 to 31/8/19 as the comparative test period.

JobKeeper fortnights

Key deadlines and Administration Considerations

- Don’t forget to still do you monthly declaration for September by 14 October 2020.

- From 28 September 2020 employers need to demonstrate that their actual GST turnover has fallen against a comparable period.

- From 28 September 2020, tier 1 and tier 2 JobKeeper rates are to be applied and are generally based on average hours worked by employees.

- By 31 October 2020 – employers must meet the minimum payment conditions for the fortnights starting 28 September and 12 October 2020.

- Employers do not need to re-enrol to claim first extension if they are already enrolled but just need to notify ATO accordingly of tiers.

- Monthly declarations continue to be required but need to include tiers for each employees.

- If you have outstanding BAS statements for comparison periods [e.g. September and December 2019], you should lodge your BAS’s as soon as possible to prevent delays in processing.

- You don’t need to reassess employee eligibility or ask employees to agree to be nominated by you as their eligible employer if you are already claiming for them before 28 September.

- You can still qualify for March 2021 quarter even if you don’t qualify for the other periods.

- Choose relevant payment tiers and notify employees within 7 days of advising the ATO of the relevant payment rate.

Have a question?

Review the detailed information from the original JobKeeper Payments here.

Replay the latest Calm Covid Convo where we dissect the most recent JobKeeper 2.0 announcement and what it means for you and your business.

In the meantime, if you have any questions or concerns, please do not hesitate to contact us and ask to speak to one of our experienced business advisors.