The sale agreement has been signed, you’ve made it through due diligence, your finances are sorted and completion is rapidly approaching; so what else should you be doing now?

The answer? More than you might think…

In part 6 of our series on rent roll transactions, we address the key steps you should take in preparation for completion [so you won’t be caught out].

calculating the purchase price

As simple as it might sound, the calculation of the purchase price is not always straightforward.

Typically, in a rent roll transaction, the purchase price for the rent roll assets are calculated by quantifying the total management fees derived from the rent roll properties managed at completion, over a particular period [usually 12 months] and multiplying that figure by an agreed multiplier.

for example:

management fees for preceding 12 months: $300,000 x 3 [multiplier] = $900,000

Given that weeks, if not months, may have passed since the signing of the sale agreement, it’s important that the seller provides an up-to-date list of managed properties prior to completion for the calculation to be accurate.

It’s also worth remembering that the above calculation may be just the starting point, as often this figure will need to be adjusted further to take account of other assets included in the sale, such as employee entitlement adjustments and premises rent.

documentation

Just as important as knowing the purchase price is knowing what you will be getting for paying it. As with business sales generally, at completion the seller typically hands over to the buyer all things necessary to carry on the business.

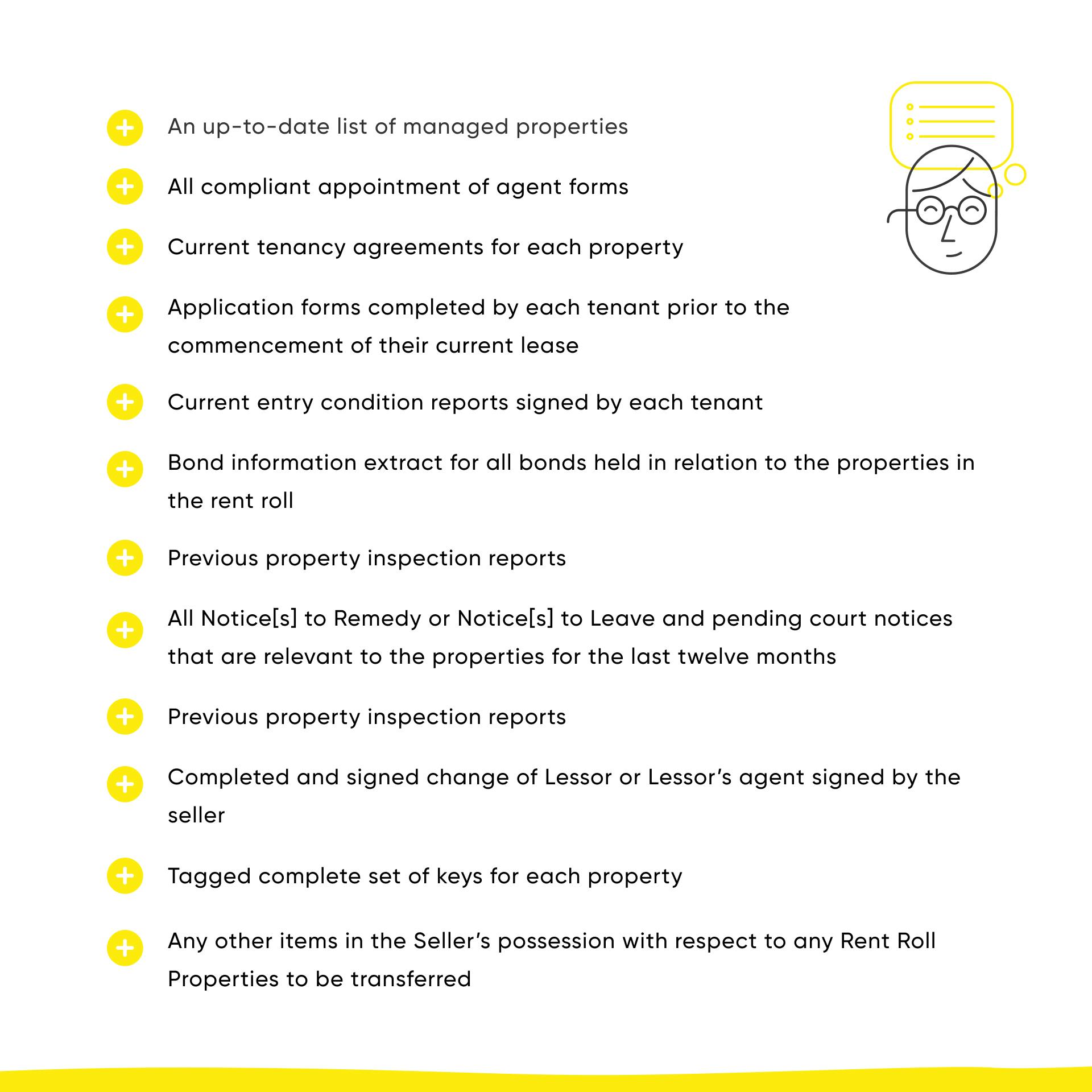

In a rent roll transaction, this typically includes a large amount of documentation, including [but not limited to]:

Buyers should also inspect and cross-check all of the documents which are provided by the seller to ensure compliance.

This is particularly so, as it’s typical for the sale agreement to only require the buyer to pay the purchase price at completion for managements where each of the required documents is has been provided.

Sellers therefore need to be proactive in ensuring that any gaps in the records [insofar as they can be] are filled prior to completion.

notifying landlords

While certain jurisdictions require the landlord to formally consent to the transfer of a rent roll management to the buyer, others [like Qld] do not.

In such cases it is preferable and often a requirement under the sale agreement, for the parties to formally notify the landlords of the upcoming completion.

This is typically done in the days leading up to completion, in a form acceptable to both the buyer and seller and serves two main purposes:

- Notifies the landlords of the name and details [including bank account details] of the incoming manager

- Helps to ensure a smooth transition, thereby streamlining the administrative processes of the buyer in taking over the rent roll

The timely issuance of notices to landlords can also help to minimise lessor discontent reducing the likelihood of the loss of managements during the retention period [be sure to check out Part 7 of our series for more information].

other requirements

In circumstances where the sale includes assets other than the rent roll itself, the parties need to ensure that those assets are effectively assigned as at completion.

These often include assets such as premises leases, franchise agreements, items of plant and equipment and employees.

The sale agreement will typically make the securing of these transfers the responsibility of the buyer, with an obligation of the seller to provide assistance where reasonably required.

With any business sale, the buyer is entitled to receive all assets free from any encumbrances or security interests and so the seller should ensure that releases of any such encumbrances or interests [including those registered on the PPSR] are organised to be released at or before completion.

key takeaways

Completion of a rent roll sale doesn’t need to be stressful. As with most things in business, preparation is key!

For sellers, ensure your house is in order and that you have all necessary documents and security releases ready to hand over.

For buyers, be proactive in the transition of the business, ensuring you’ve lined up all other assets and most of all…have the money ready to go!

we’re here to help

If you are considering selling or buying a rent roll, feel free to reach out to us at legal@businessdepot.com.au or give us a buzz at 1300BDEPOT to discuss the potential agreement and all aspects of the sale or purchase.

get more insights

If you liked this information and want to get more info on all legal, subscribe to our mailing list below!

general advise disclaimer

The information provided in this booklet is a brief overview of the subject matter and does not constitute any type of advice. We endeavour to ensure that the information provided is accurate however, information may become outdated as legislation, policies, regulations and other considerations constantly change. Individuals must not rely on this information to make a financial, investment or legal decision and should consult an appropriate professional before making any decision.