When I talk about businesses that achieve above-average results, often they have more than one owner working in the business. Maybe this is because the business benefits from at least two people being hands-on and having a vested interest in the success and future of the business. Or maybe, just maybe, when unrelated parties are in business together, there is more need for better governance, communication, and systems.

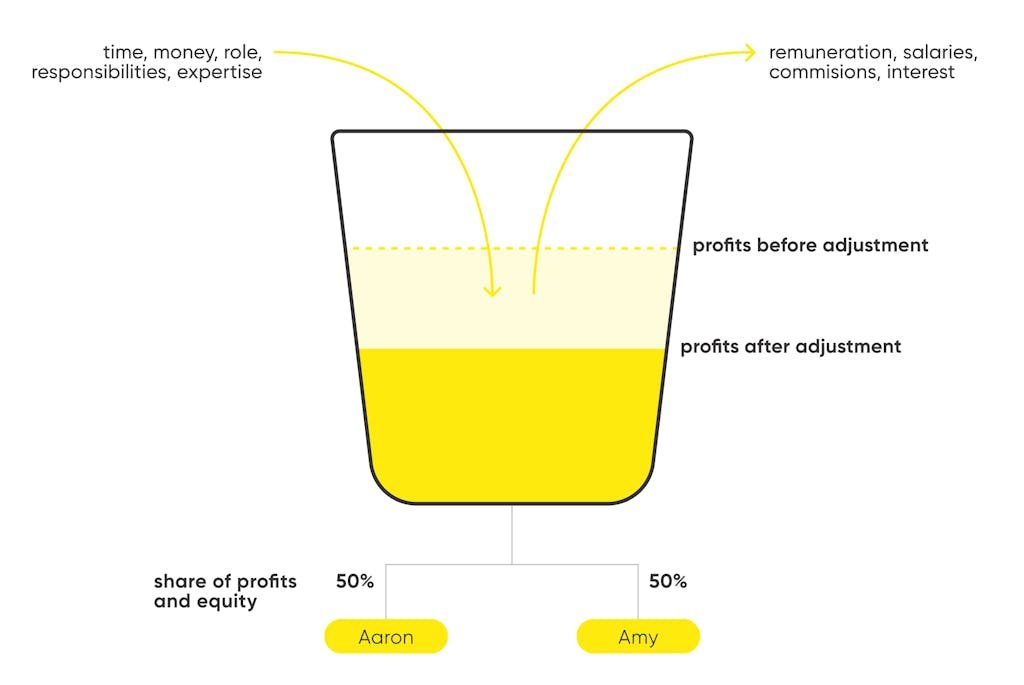

Not all partnerships are successful – in fact, many of them fail. There can be a whole range of reasons why, but I believe the number one cause is a lack of discussion or implementation of a strategy around each party’s contribution to the business. To explain, I use what I call the ‘bucket analogy’.

Think of it this way:

- Every business has a bucket. This is where all the profits and equity of the business accumulates before being distributed.

- Profits and equity are distributed in proportion to your ownership percentages [so if it is a 50:50 partnership, 50% would come out to each partner].

- Each partner is required to put something at the top of the bucket [this may be time and effort, money, referrals, and so on].

- Sometimes a partner will take something out of the bucket before the profits and equity are distributed in their ownership percentages [such as a wage or a commission].

- If items of a different value are being put into the top of the bucket [point 3 above] then it is essential that something comes out of the bucket [point 4 above] before profits and equity are distributed.

- If this doesn’t happen, over time one partner will feel like they have contributed more than the other. Eventually, their dissatisfaction will build to a point of frustration, preventing the partners from working effectively together.

Let me give you an example:

- Aaron and Amy decide to go into business together and buy their boss out.

- Aaron has been the number 1 salesperson in the team for years and has taken on a leadership role with the rest of the team.

- Amy has been running the operations side of things and has put a lot of time and effort into building a strong back end for growth.

- They decide to buy the business through a company with 50:50 ownership and they each finance their share of the business separately.

- Both partners are expected to devote 100% of their work time to this business.

- The plan is for Amy to continue to run operations and invest in the backend processes and systems so they can keep scaling.

- Aaron is to run the sales team while still making his own sales to improve profitability and reduce risk.

Typically, the key arrangements that need to be agreed upon relate to remuneration:

- What commission and/or salary [if any] does Aaron get for the sales of him and his team?

- What remuneration does Amy get for managing the back office?

It is tricky to compare the roles and remuneration in this scenario because one contributes to sales and immediate cash flow while the other contributes stability, efficiency, and capital value.

Aaron and Amy may agree that they are to contribute the same amount of ‘value’ and not require any adjustment in remuneration. But if they do not have this discussion upfront or implement a strategy to deal with any real or perceived inequality, sooner or later someone will feel ‘ripped off’ and the partnership will fail.

If you are thinking of entering into a partnership, discuss the drivers of any arrangement with a businessDEPOT business lawyer, and speak to the right person for the right advice and document in a partnership/shareholders agreement.