Although this year could hardly be called an Oprah budget’ [where you get a car and you get a car!], its’ definitely a mixed bag with tax cuts and lolly-size handouts for everyone. The challenge with this years’ budget was always going to be if the Treasurer could walk the tightrope of relieving cost of living pressures while keeping inflationary pressures under control.

Although there were no major tax reforms and no major innovation for business owners, there were also no increases in tax and some long-term investment initiatives in housing, manufacturing, green energy and skills for the future.

here’s our top takeaways from Budget 2024 for business owners:

1. inflationary pressures eased or exasperated?

Not for a very, very long time have inflation rates been at the top of the list of things we’ve been looking for in the Federal Budget. Undoubtedly, inflation and its impact on interest rates is the number one factor impacting Australians right now [whether they’re business owners or not].

With billions of dollars being spent in this budget, the big question is, will this help or hinder inflation rates [especially when everyone is getting a tax cut and an energy rebate to spend]?

The budget forecasts the consumer price index [CPI] and wage price index [WPI] as follows:

Many economic commentators have been blaming the services segment for keeping inflation high. If wages are going to grow at a faster rate than overall inflation, how are businesses in the services sector [where wages are the major cost input], going to be able to prevent prices for services going up?

2. small business Instant Asset Write Off extended again

What was old is new once again [still]! The Government has extended the $20,000 instant asset write off [IAWO] for small businesses with turnovers of less than $10 million for the 2025 financial year. The IAWO will apply separately to assets allowing business owners to reap the tax benefits on a significant portion of their capital expenditure for the 2025 year.

With theTemporary Full Expensing Levy finishing at the end of the 2023 year, the Government has returned to form with the least inspirational form of business incentive for small business, a renewal of the $20,000 instant asset write off!

Are you a small business with turnover of less than $10 million? Are your key capital investments less than $20,000? If so, then you can qualify for the IAWO [all assets depreciated separately].

If not, it’s back to the depreciation pool for you, have a swim and cool off from all that intensive capital expenditure.

3. jobs, skills + education to reignite Australia’s engine room

Skills! Skills! Skills! Well not quite… while the Government policy focus is not a direct rehashing of the old Coalition ‘Jobs Jobs Jobs’ slogan there are definite parallels with a key budget focus on driving skills development through an additional 20,000 free TAFE spots and fast tracking 1,900 assessments for skilled migrants in the construction and other traditional blue collar sectors to kick-start Australia’s manufacturing and housing construction markets.

To hammer the point home the Government is introducing a twist on the old ethos of ‘build it and they will come’ to ‘build it, or we won’t let them come’, forcing universities to make more investment into the development and construction of student accommodation which will have a direct impact on the number of foreign student places offered.

The Government has also committed to a goal of having 80% of all Australian’s completing some form of tertiary education by 2050 to address the long term skills shortage.

4. stage 3 tax cuts 2.0 [old news now]

Earlier in the year the federal government announced earlier a change to the stage 3 tax cuts that had previously been legislated.

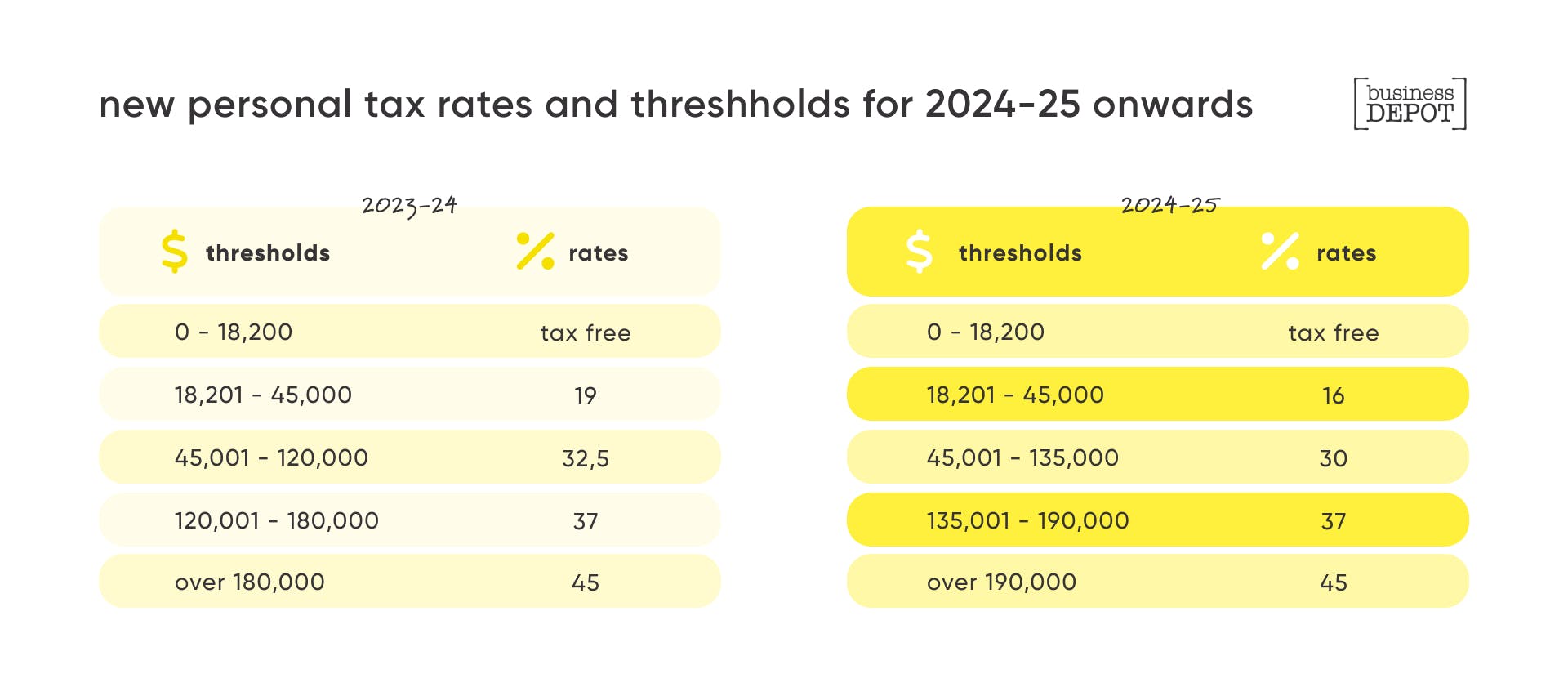

One of the biggest changes in this budget is the implementation of the final version of the stage 3 tax cuts. Tax rates from 1 July 2024 will be as follows:

Although the previously legislated tax cuts made a fundamental change to the income tax system by flattening the tax system with completely abolishing the 37% tax zone, this does spread the tax cuts to everybody. The top tax rate remains unchanged at 47% [being 45% plus 2% medicare levy] but kicks in now at $190,000 rather than $180,000.

This graphic from the Budget papers summarise the individuals to benefit from these tax rate changes as follows:

Source: Budget 2024-25 overview

With some business owners using multiple families to distribute income, you will now ultimately be able to distribute more to your family members at a lower tax rate. But please be aware, the ATO is cracking down on making sure if you distribute to family members, they expect the money to flow to them as well!

5. housing support – an opportunity for some

Relieving the pressure on housing could be an opportunity for the property development, construction and real estate sectors.

The budget is setting out the governments’ plan to relieve the pressure on housing across Australia with a range of initiatives including;

- Increasing Commonwealth Rent Assistance by a further 10% [on top of the 15% from September 2023].

- New housing investments including $6.2 billion in specific initiatives.

- Money for the State Governments to help them deliver more housing and connecting essential services such as water, sewerage, power and roads.

- Attention on making student accommodation more available as a way to support those that want to further their education.

- $16.5 billion additional funding for infrastructure projects to connect our cities and towns including money to improve transport networks in Western Sydney and connecting the Sunshine Coast and Brisbane with a direct rail line.

It will be interesting to see if these initiatives will create the incentive for private enterprise to develop land and build new houses/units, and ultimately increase supply so that the pressure on house prices and rents is eased.

6. looking forward with ‘A Future Made in Australia’

Exactly what the government will do with this package is still very vague.

With a focus on what they’re calling ‘priority industries’ it would appear the intention is to support private sector and corporates to invest in opportunities at the ‘intersection of industry, clean energy, resources and human capital’.

It was hoped we would get some more detailed information on this package in the budget… but that is not the case. Watch this space to see if it could present an opportunity for you and your business.

7. HECS-HELP rollback

Whoops, our bad – here, have a discount! Pain and bill shock were experienced by most with student loans in June last year, but to ease the debt burden the Government will be rolling back the CPI indexation of all HECS-HELP loans to 1 June 2023 and applying a reduced indexation rate.

The intensity of last year’s backlash was so strong, the Government has been forced to adopt a new mechanism for indexation going forward whereby indexation will be capped at the lower of CPI and the Wage Price Index. At this stage it’s not clear when the credit from 2023 will be applied to existing loans or how any refunds may work.

With many business owners paying down the HECS-HELP debt of their kids through family trust distributions this will be an appreciated ease in the debt indexation.

8. energy + net zero

The Government is introducing new tax incentives for green hydrogen and critical mineral production as part of the pathway to net zero as well as investing into Australian battery and solar panel manufacturing capabilities. However, at this stage there is little detail regarding how the incentives will work and how accessible they will be to businesses.

The Government is also introducing an Energy Efficiency Grant program for small businesses who will be able to apply for grants of up to $25,000 to upgrade the energy efficiency of their appliances and heating and cooling systems.

This is possibly an opportunity for those with businesses in this sector as much as anything.

9. continued Medicare and care economy support

The government is aiming to ease pressures on the most vulnerable with additional funding to ensure the cost of medical care remains affordable.

Workers in the aged care and care economy will be rewarded with an increase in the award wage for the 2024 year to incentivise further employment in the sector as Australia’s aged care industry continues to grow at record pace.

The Government will also freeze and limit the price of prescriptions provided under the Pharmaceutical Benefits Scheme [PBS] to $31.60. The limit will be reduced to $7.70 for concession card holders and pensioners who will also benefit from an extended price freeze lasting 5 years.

10. energy rebate for everyone

You get an energy rebate, you get an energy rebate… everyone gets an energy rebate! But unlike Oprah’s generous car giveaways, it’s hard to get excited about this.

The government is spending $3.5 billion by giving a $300 energy rebate to every Australian household and $325 to small businesses.

With the government arguing this will directly put downward pressure on inflation, it will be effective from 1 July 2024.

$325 is hardly going to change the life of a small business owner who has possibly already put everything on the line for their business.

a couple of other interesting points from the budget

- unpaid super: Increased funding to pursue unpaid superannuation entitlements owed by employers in liquidation or bankruptcy from 1 July 2024.

- super on paid parental leave: Superannuation will be paid from 1 July 2026 on Paid Parental Leave [read more about this in our ‘budget for women’ blog by Rebecca Mihalic

- ATO data protection: The ATO has been given more funding to implement system upgrades to prevent fraud and better protect taxpayer date.

- Continued support for ATO to pursue debts: The ATO Personal Income Tax Compliance Program will be extended for one year from 1 July 2027 and an extra $44m of funding to the ATO. This program will continue the support for the program, which has many taxpayers seeing a more aggressive ATO.

- Digital ID and myGov: Additional funding is committed to the myGov and Digital ID systems

- Research + Development: R+D systems still the subject of a review.

- Limit on ability for ATO to recover real old debts: A change in the tax law is proposed so the ATO has the discretion to not use a taxpayers refund to offset old tax debts that had previously been put on hold prior to 1 January 2017 [individuals, small businesses and not-for-profits]

This article was co-authored by Benjamin Leopold, Accounting Manager at businessDEPOT.

want to learn how the budget will impact women?

We were promised a budget that would be “good for women” but did we get it? To read our breakdown on measures that are specifically ‘for women’ [versus ‘for everyone’], check out Rebecca Mihalic’s ‘2024 budget for women’ blog.

we’re here to help!

If you need help understanding what the budget means for you or you’d just prefer to know exactly how it will affect your affairs, please give us a buzz on 1300BDEPOT or email us and our team will be happy to help.

get more insights

If you found these tips and tricks useful and you’d like to get more information, you can sign up to our mailing box here!

general advice disclaimer

The information provided on this website is a brief overview and does not constitute any type of advice. We endeavour to ensure that the information provided is accurate however information may become outdated as legislation, policies, regulations and other considerations constantly change. Individuals must not rely on this information to make a financial, investment or legal decision. Please consult with an appropriate professional before making any decision.