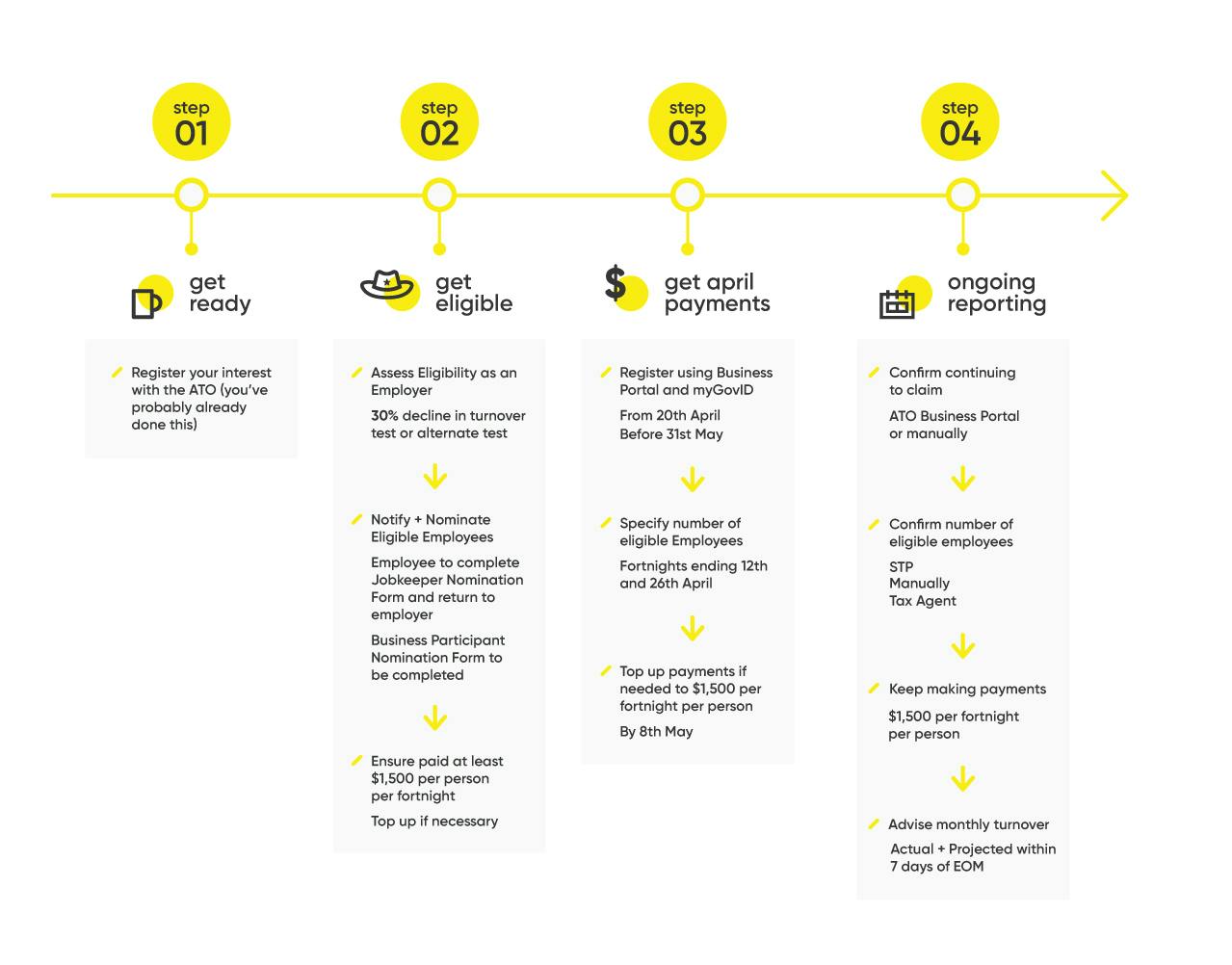

We have summarised for you all the steps you need to follow to register for JobKeeper Payments and stay eligible:

Key Dates are summarised as follows:

- 8 May 2020 = Date you need to have paid the minimum amount to all eligible employees [this has been extended from 30 April]

- 31 May 2020 = Enrol for JobKeeper with ATO to qualify for the initial fortnights of JobKeeper but you can enrol for later months at a later date [this has been extended from 30 April]

Get ready

Step 1: Register your interest

Register your interest on the ATO website and subscribe to receive JobKeeper payment updates [you have probably already done this]. Also stay up to date with our blogs, webinars and related content.

Get Eligible

Step 2: Employer Eligibility

Assess if you are an Eligible Employer for the JobKeeper payments.

Step 3: Employee Eligibility

Confirm your employee/s are Eligible Employees under the JobKeeper Payment Scheme.

Step 4: Minimum Payments

Continue to pay at least $1,500 to each eligible employee per JobKeeper fortnight [the first JobKeeper fortnight is the period from 30 March to 12 April]. You have until 8th May [previously 26th April] to catch up on the previous 2 fortnights.

Step 5: Notify Employees

Notify your Eligible Employees that you are intending to claim the JobKeeper payment on their behalf and confirm they are not claiming JobKeeper Payment through another employer or have nominated through another business.

Step 6: Nomination Notice Form

Send the JobKeeper Employee Nomination Notice Form to your nominated employees to complete [see attached]. This needs to be returned by the end of April if you plan to claim JobKeeper payment for April:

- Keep it on file and provide a copy to your contact at businessDEPOT [if you are a client].

- This form does not need to be lodged with the ATO.

- Attached is a copy of the JobKeeper Factsheet should you wish to provide it to your employees with the nomination form.

There is also a different form if you intend to nominate a self-employed person as a business participant [other then sole trader] … click here to access the form.

Get April Payments

Step 7: Register for JobKeeper

From 20 April 2020, you can enrol for the JobKeeper payment using the Business Portal and authenticate with myGovID. If you would like some help, we are here and can lodge it on your behalf if we are your tax agent!

*You must enrol by 31 May [previously 30 the April] to claim the JobKeeper payments for the 4 weeks ending 26th April 2020.

Step 8: Register Employees

Specify the estimated number of employees who will be eligible for the first JobKeeper fortnight [30 March – 12 April] and the second JobKeeper fortnight [13 April – 26 April].

Ongoing Reporting

Step 9: Apply to Claim

Apply to claim the JobKeeper payment by logging in to the ATO Business Portal

Step 10: Check paid minimum pays

Ensure you have paid each eligible employee a minimum of $1,500 per JobKeeper fortnight before tax [first JobKeeper fortnight commences 30th March].

Step 11: Identify eligible employees

Identify your eligible employees by either:

- selecting employee details that are prefilled from your STP [Single Touch Payroll] pay reports if you report payroll information through a STP enabled payroll solution, or

- manually entering employee details in ATO online services or the Business Portal if you do not use an STP enabled payroll solution, or

- using a registered tax agent [like us] who will submit a report on your behalf through Online services for agents.

Step 12: Submit with ATO

Submit the confirmation of your eligible employees online and wait for the confirmation screen.

Step 13: Notify Employees

Notify your eligible employees you have nominated them.

Step 14: Receive payment

The ATO will pay you the JobKeeper payment for all eligible employees after receiving your application.

Step 15: Reconfirm each month and Report Income

Each month, you will need to reconfirm that your reported eligible employees have not changed through ATO online services, the Business Portal or via your registered tax agent. This will ensure you will continue to receive the JobKeeper payments from us. NB: You do not need to retest your reported fall in turnover, but you will need to provide some information as to your current and projected turnover. This will be done in your monthly JobKeeper Declaration report [which again we would be happy to help with].

Step 16: Notify of changes to Eligible Employees

If your eligible employees change or leave your employment, you will need to notify ATO through your monthly JobKeeper Declaration report.

We discussed these processes and more in a ‘Calm Covid Convo’ on 21st April 2020 … a recording of the webinar is available to watch on-demand here. Please note dates mentioned in this video may have been updated.

Xero Processing Tips

You can process a top-up JobKeeper amount in Xero as follows:

- Xero has set up an allowance pay item automatically for everyone [this is exempt from super]

- This pay item should be used to process the top-up amount [or the whole amount if they aren’t working at all]

- Run normal payroll – If an employee earns less than $1,500 for that fortnight or $750 for the week, add an extra line in under the earnings rate and select JobKeeper Payment top up and add in the top-up required [you should see that it does not add super]

- If you need to go back to top up previously paid April pay runs, you can do this using unscheduled pay runs.

You can enrol employees using Xero as follows:

- Inside the payroll page, there is a link to Xero COVID 19 Assistance

- Xero will pull out details of your potentially eligible employees automatically.

- Select employees you want to claim for and the relevant start date.

- Be careful as this cannot be edited once it is done.

Of course, everyone at businessDEPOT is here to help. If you would like us to attend to all of this for you, please reach out to your usual contact or oneplace@businessdepot.com.au or 1300 BDEPOT